Hedge Against Inflation with Bitcoin

Governments have abused their powers of money creation. Each newly-printed unit of government fiat currency gets its value by taking a small amount of value from each unit of existing currency. Governments are able to spend the newly-issued currency before the effects of inflation trickle down to society. Inflation is a hidden tax on all citizens.

- How Bitcoin is Different

- Bitcoin is Deflationary

- Bitcoin’s Special Properties

- Buy Bitcoin

- Bitcoin’s Price

- The World Needs Bitcoin

Before Bitcoin, people were locked into the traditional financial system. Bitcoin offers an easy way for people to exit economies that revolve around government fiat money and bad monetary policy.

How Bitcoin is Different

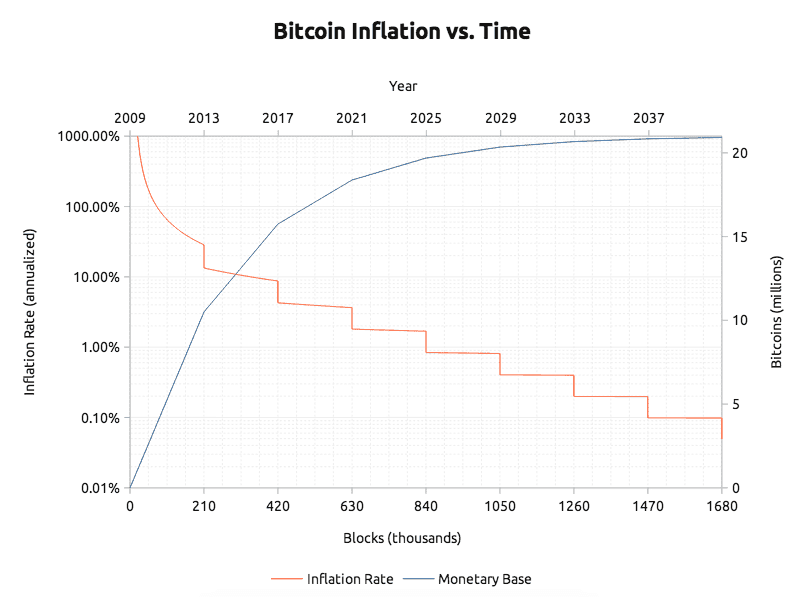

A network of distributed computers, not politicians, controls Bitcoin’s supply, which is capped at 21 million bitcoins. Everyone can see when new bitcoins are issued and exactly how many bitcoins exist.

Government fiat currencies are closed systems. New money can be issued at random whenever policy makers decide to do so. Bitcoin is open and voluntary. Bitcoin’s controlled supply offers predictability to investors and users.

Bitcoin was specifically built to solve the problems of fiat money, and to give users a trustworthy system. Here is Satoshi Nakamoto, the creator of Bitcoin, introducing Bitcoin back in 2009:

The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.

Bitcoin is Deflationary

Although Bitcoin will be somewhat inflationary in its early years, the 21 million cap will eventually make Bitcoin a deflationary currency. In the same way there is only so much gold in the world, there will be a limited amount of bitcoins. As more gold is mined, less gold remains to be mined and it becomes increasingly difficult to extract new gold. The same is true of Bitcoin.

Deflationary currency encourages and rewards saving because purchasing power increases with time. Deflationary currency gives more power to holders, and strips power from any central authority.

Bitcoin’s Special Properties

Bitcoin gives people more financial freedom. Payments of any amount can be sent to any other Bitcoin user, anywhere in the world. Unlike a bank account, your Bitcoin wallet cannot be shut down or blocked. Bitcoin allows an exit from the broken financial systems, which have harmed the lives of so many innocent, hardworking people. Because Bitcoin is digital, anyone in the world with an internet-connected device now has a way to access sound money.

Early investors bought bitcoin because of the guarantee of a fixed supply. Buyers understood the terms of their investment from the start—that there will only be 21 million bitcoin. All Bitcoin users know the inflation rate and total number of currently issued coins. 100% knowledge of currency supply and rate of issuance gives investors more confidence, encourages further investment, and helps bitcoin retain its value. This differs from government fiat money, which can be printed when policy makers decide to do so.

Bitcoin was introduced as a “peer-to-peer” cash system, but has been used more as a store of value—a digital gold. Sound money, free of government control is one of the most important features of Bitcoin. Bitcoin is a payment system at its core, but its use as “digital gold” and a store of value have been its biggest applications.

Buy Bitcoin

When you buy bitcoin, you store it in a digital wallet that only you control. After buying bitcoin, you should immediately send your coins to a wallet you own. This is the recommended way to use Bitcoin to protect yourself from inflation and opt out of bad monetary policy.

Services like Coinbase let you exchange your fiat money for bitcoins at a flat rate of 1% per transaction.

Bitcoin’s Price

There is no guarantee that Bitcoin’s price will continue to rise. However, more and more people are starting to see the value in holding a currency like Bitcoin, that isn’t issued by government.

Gresham’s law states: “Bad money drives out good”. We are seeing this with Bitcoin. Although people aren’t using Bitcoin to make their daily purchases, it’s still seen as good money. People tend to buy bitcoin and stash it away. Most Bitcoin users aren’t using the currency every day, but rather hold their bitcoins in expectation of future gain. For example, a user who believes one bitcoin will be worth $10,000 in the future would prefer to spend his U.S. dollars and save his bitcoins. This phenomenon helps to increase Bitcoin’s price, which gives it more liquidity.

The World Needs Bitcoin

Most people may not know it yet, but the world needs Bitcoin. Use it now to protect yourself from inflation and to escape failed government economic policy. Bitcoin is the ultimate exit.

Use our country index to find a place to buy bitcoin in your country. Or use our tool to find bitcoin exchanges and brokers based on your country and preferred payment method.

Further reading:

Categories