How to Store and Protect your Bitcoins

A Bitcoin wallet is the first step to using Bitcoin. Without a wallet, you can’t receive, store, or spend bitcoins. Bitcoin wallets contain private keys; secret codes that allow you to spend bitcoins. In reality, it’s not bitcoins that need to be stored and secured, but the private keys that give you access to them.

![]()

Bitcoins can be stored in a number of different kinds of wallets. Each wallet has pros and cons, and different wallets are built to solve different problems. Some wallets may be geared towards security, while some wallets may be more focused on privacy. Your specific needs should determine the wallet you use, as there is no “best way to store bitcoins”.

Before reading on, understand why you’re using Bitcoin and what you need it for. After reading this article, you should have a much better idea of what kind of wallet will be right for you.

Hot Wallets

Hot wallets are Bitcoin wallets that run on internet connected devices like a computer, mobile phone, or tablet. As we mentioned earlier, private keys are secret codes. Because hot wallets generate private keys on an internet connected device, these private keys can’t be considered 100% secure. Hot wallets should be treated like your pocket, or purse, wallet today: used to carry cash that’s needed for day-to-day spending, but not to store your savings account. You can always replenish your hot wallet with funds from your more secure Bitcoin wallets (more on this below).

The first type of hot wallet is a software wallet. Software wallets are apps that are downloaded to your phone, tablet, or computer. The most popular software wallets are Mycelium (Android & iOS), breadwallet (iOS), Electrum (desktop), and Bitcoin Wallet (Android).

Web wallets are the second type of hot wallet. Our knowledge base article on Bitcoin wallets explains best:

A web wallet is a wallet where the private keys are stored in the cloud rather than a local computer. This allows a user to easily have access to their bitcoin on multiple devices. Private keys are generated locally and then encrypted, which means the wallet application provider does not have access to user funds. An example of this type of wallet is Blockchain.info.

Cold Storage

Private keys that are generated offline in a secure environment are called cold storage. Cold storage is similar to your bank savings account. It is generally recommended that most of your Bitcoin wealth be stored in cold storage wallets.

Because bitcoins are digital, cyber-criminals could, potentially, target your computer and steal your bitcoins. Generating private keys offline ensures that hackers have no way to reach your bitcoins.

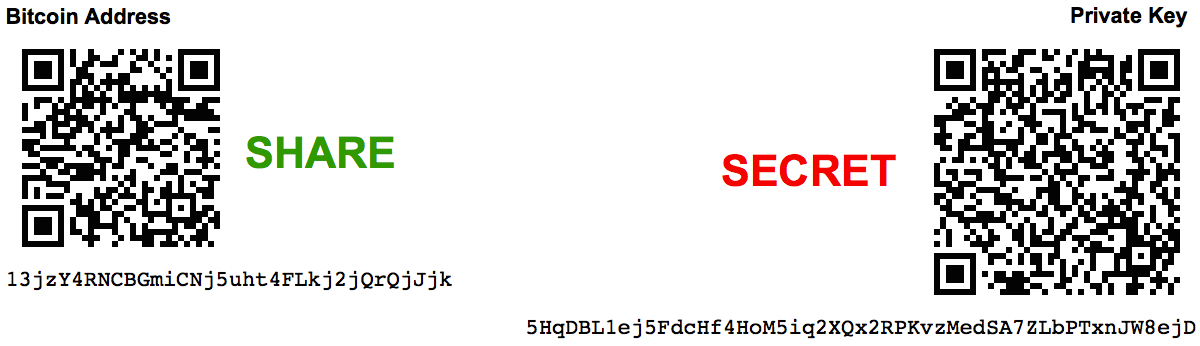

Paper Wallets

A paper wallet is the most basic form of cold storage. A paper wallet is created by generating a private key on an offline computer. The private key is then printed and kept in a secure, private location. Paper wallets were the most common form of cold storage until hardware wallets became popular. Some printers store data or content, and, therefore, may be a security risk. A dedicated printer should be used for increased security.

Paper wallets are easy to generate securely, but extra precautions must be taken once the wallet has been physically printed. Let’s take a look at how your paper wallet funds could be jeopardized even if generated securely from the start.

Theft

Remember how we said private keys must be kept secret? What if a friend knew about your bitcoin holdings and found your paper wallet? He or she would be able to steal your funds very easily.

There are a few options to prevent this scenario. The easiest option is to use a BIP38 encrypted paper wallet. In simpler terms, BIP38 wallets are encrypted with a passwords. This means if someone physically finds the paper wallet, a second password is still needed before the paper wallet can be opened. A BIP38 wallet private key could be posted on the internet for anyone to see and the funds would still be secure if a strong password was used.

Another way to prevent physical theft is to simply keep your paper wallet in a physically secure, secret location, to which only you have access.

Accidental Damage

Consider if you printed out your paper wallet and thought your Bitcoin funds were safe for the long run. What if your wallet was at home and a fire burned down your house? Your bitcoins would be gone forever.

This illustrates the importance of multiple backups. Your paper wallet can be printed an unlimited number of times. Store your wallet in multiple secure physical locations so that in the event that one of your backups is lost or damaged, you still have access to your funds. Paper wallets can also be laminated to protect against water damage. For the super paranoid, engrave your paper wallet’s private key into metal.

Hardware Wallets

Hardware wallets are small, USB sized devices that generate private keys in a secure, offline environment. Hardware wallets are great for both secure storage and frequent spending.

Most hardware wallets will generate a random 24-word seed upon creation. The seed is a random string that can only be generated once. The hardware wallet generates a list of addresses based on this seed.

If the hardware wallet itself is damaged or lost, the seed can be used to backup all funds. The same principles that apply to paper wallets and private keys apply to hardware wallet seeds. Keep them physically secure and secret; anyone with access to the seed can steal your funds.

TREZOR - The Bitcoin TREZOR was the first Bitcoin hardware wallet. The TREZOR is a mini-computer built for the sole purpose of generating secure Bitcoin private keys and signing transactions. Learn more about TREZOR.

Ledger - The Ledger Nano is similar to the TREZOR, but instead uses a smartcard to generate private keys and sign transactions. Learn more about the Ledger Nano.

Brain Wallets

A brain wallet is a private key that is generated based on input from a user. Brain wallets have some unique use cases, but aren’t recommended for most users.

Brain wallets are useful for users who don’t trust random number generators. Paper wallets and wallet seeds are created using entropy from your computer, phone, or hardware wallet. If you don’t trust these systems, a brain wallet can be used to create addresses using your own entropy such as dice rolls or your own random words.

Secure your bitcoins

No matter what wallet you choose, remember that your bitcoins are only safe if the private key was generated securely and remains a secret. Choose a storage method based on your needs and your wealth. There’s no reason to ever store a large amount of funds in a hot wallet.

Following these three basic principles should help you avoid theft, scams, and any other loss of funds:

1) Generate your private keys in a secure, offline environment (besides small amounts stored in a hot wallet).

2) Create backups of your private keys or wallet seed ensure that no small accident causes a loss of funds.

3) Encrypt wallets to provide additional security and prevent physical theft of your funds.

Securing your bitcoins properly is the most important step for any Bitcoin user. With Bitcoin you have the financial freedom to store your own money. There have been countless scams related to Bitcoin that could have been prevented had people not trusted others with their bitcoins. Never trust anyone else with your money.

Categories