How to Trade Bitcoin

Note: if you wish to speculate on Bitcoin price movement without owning any bitcoins, check out AvaTrade or Plus500 CFD Service. Your capital is at risk with any trading service.

To the uninitiated, Bitcoin trading can seem like a dream job, reserved for the fortunate few who trade Bitcoin from home, set their own hours and perform nothing more strenuous than clicking a mouse or watching a screen. The harsh reality is that the overwhelming majority of new traders lose money and quit within a year. All those washouts likely thought themselves future members of that exceptional minority of traders who achieve consistent profitability.

- Trading Bitcoin vs. Bitcoin Investing

- Bitcoin Trading Advantages

- Ways to Trade Bitcoin

- Fear and Greed

- Money Management

- Profit Targets and Stop-Losses

- Risk / Reward Ratio

- Trading Tips

- Timeframes Define Bitcoin Traders

- Trending vs. Rangebound Markets

- Indicators and Patterns

- Trading Plan

Why is trading such a difficult endeavour? Firstly, due to the intrinsic unpredictability of markets. The human mind, which excels at pattern recognition, struggles with random outcomes. Secondly, trading is emotionally-taxing, involving long hours of boredom interspersed with periods of intense stress. Finally, as traders risk their own capital in an endless zero-sum game, trading is an occupation which bears close resemblance to professional gambling. Even successful traders frequently succumb to burn-out due to the pressures involved.

Except in the marketing of trading courses, products or services, trading Bitcoin is no glamorous road to easy riches. Rather it is an activity demanding great patience, control and discipline. New traders are likely to lose money as they develop their skills and achieving consistent profitability is never guaranteed, even for the most experienced Bitcoin trader.

Trading Bitcoin vs. Bitcoin Investing

This article discusses the active trading of Bitcoin as an (additional) occupation or supplementary income source. Trading Bitcoin is similar but distinct from investing in Bitcoin.

An investment in Bitcoin is a long-term undertaking, often with multiple goals such as portfolio diversification, fiat risk hedging, business or ideological objectives, etc. Bitcoin investors are generally insensitive to price volatility and unlikely to exit their positions, barring some dire eventuality.

By contrast, most Bitcoin traders maintain only short-term positions, staying in a trade for a maximum of a few months - but often for no more than a few hours. Bitcoin traders are also extremely price-sensitive, striving for perfect entry and exit prices and abandoning their positions immediately if they prove unprofitable.

Bitcoin Trading Advantages

For trading purposes, Bitcoin is superior to other instruments, such as stocks, commodities or Forex, for at least 3 reasons:

1) Bitcoin’s exceptional volatility allows for high percentage profits without leveraging. Large price moves, the average trader’s bread and butter, are far more common in Bitcoin than almost any other instrument. Therefore, Bitcoin traders may eschew the increased risk and expense of leverage strategies designed to extract high profits from small moves.

2) Bitcoin trades non-stop; 24 hours a day, 7 days a week. By contrast, stocks and commodities only trade during business hours and Forex markets shut over the weekend. Trade in Bitcoin remains active around the clock as volume is distributed primarily across American, European and Asian sessions.

3) Bitcoin is probably the cheapest, quickest and most convenient instrument to trade. Bitcoin exchange fees are minimal compared to traditional exchanges and Bitcoin deposits or withdrawals are accomplished within hours from anywhere in the world. Less stringent requirements for personal information are the norm for Bitcoin exchanges, particularly if deposits and withdrawals are handled exclusively in Bitcoin.

Ways to Trade Bitcoin

Short-term traders rely on real-time data feeds and liquid markets to enable rapid entry to and exit from trades. Sophisticated, high-volume exchanges are preferred, if not required. To be considered a suitable trading venue, an exchange must allow traders to profit from downward price moves by offering the capacity to short sell.

The necessity of holding funds in cryptocurrency and fiat form dictates that “trader exchanges” be centralised services, although this may change with the advent of next-generation decentralised exchanges. Whenever funds are held by a third party, there is custodial risk) - so choose your exchange wisely.

Prefer those exchanges which offer proof of reserves for client Bitcoins, regular external audits for client fiat funds and have a long history of secure, ethical operation. For convenient trading, select an exchange which also offers decent volume and a real-time, responsive trading interface.

Frequently recommended to Western traders are Bitcoin exchanges such as BitFinex, Bitstamp, BitMex and Kraken. For non-residents comfortable with China’s rather opaque regulatory environment, the low fees and deep volume of Chinese Bitcoin exchanges, such as Houbi, BTCC and OKCoin, are undeniably attractive.

Options - not to be confused with binary options - are now available to Bitcoin traders through BitMex. When properly employed, option strategies meaningfully extend a trader’s range of market actions. Options allow for the inexpensive hedging of market positions, the trading of volatility and a great deal more. Although complex, options are worthy of investigation due to the unparalleled flexibility they afford.

Bitcoin binary options, which effectively constitute bets on future price, are available from various brokers, such as BTC Oracle. Binary options aren’t recommended for dedicated Bitcoin traders, who have better options elsewhere.

A final important point is that traders may speculate on Bitcoin’s price without ever touching Bitcoin. Online exchanges like Plus500 and AvaTrade allow for price speculation via fiat-only Contracts for Difference (CFDs). Such exchanges additionally offer a variety of other markets to trade, such as Forex and commodities, although their costs are higher than those of Bitcoin exchanges.

Fear and Greed

For all their technological sophistication, markets are driven by these primal human emotions.

To become a successful Bitcoin trader, it’s necessary for an individual to manage these responses appropriately. Great opportunities present when the market becomes irrational due to an abundance of fear or greed. This frequently occurs following major price movements or dramatic news. At such times, weaker traders are overwhelmed by emotion and misprice their trades.

Market chatter can provide insights into the market’s current mood but by following it too closely you risk becoming infected by market hysteria. Excitable market participants will shout “pump!” and “moon!” or “dump!” and “doom!” with every $10 price move up or down. Some traders will support whichever direction favours their pocketbook as if cheering their favourite sport team. And the media and public figures can be just as irrational. Strive to stay objective when taking the market’s emotional pulse.

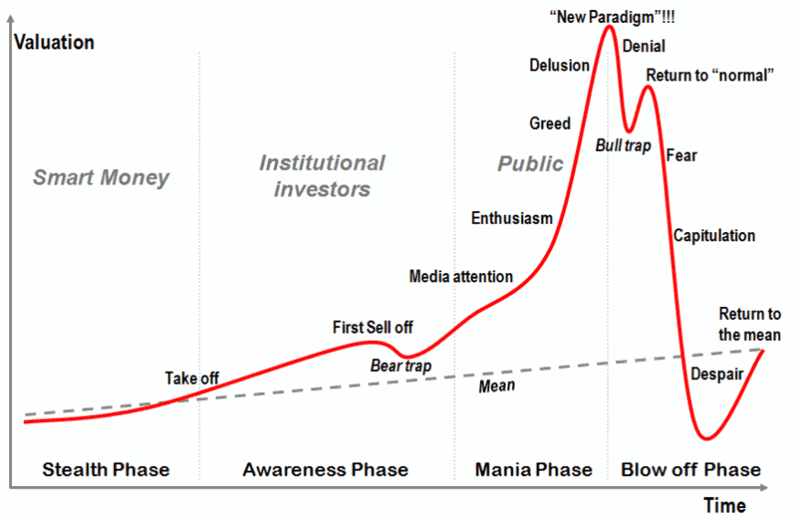

Smart investors build long positions when price is flat and public interest is low during the stealth phase. Traders aim to open long position in the troughs (bear trap, bull trap and despair) and open short positions at each peak (first sell off, “new paradigm,” and return to “normal”). Traders thus attempt to profit from every phase of the cycle; a lot harder but also far more profitable if achieved.

Money Management

Perhaps the most important element of trading is capital preservation. Before undertaking to trade Bitcoin, consider how much money you can afford to lose before your current lifestyle becomes unaffordable. This will allow you to better determine your “pain point,” or how much wealth you’re willing to risk losing. Never commit any more than this sum to your trading account.

Of this trading capital, never risk more than 5% on a single trade. Neophyte traders should not risk more than 1%. If your trading is successful, the size of each trade in absolute terms steadily grows as your trading account swells. If unsuccessful, at least losses are kept to a minimum, which allows time to adjust your trading plan.

Profit Targets and Stop-Losses

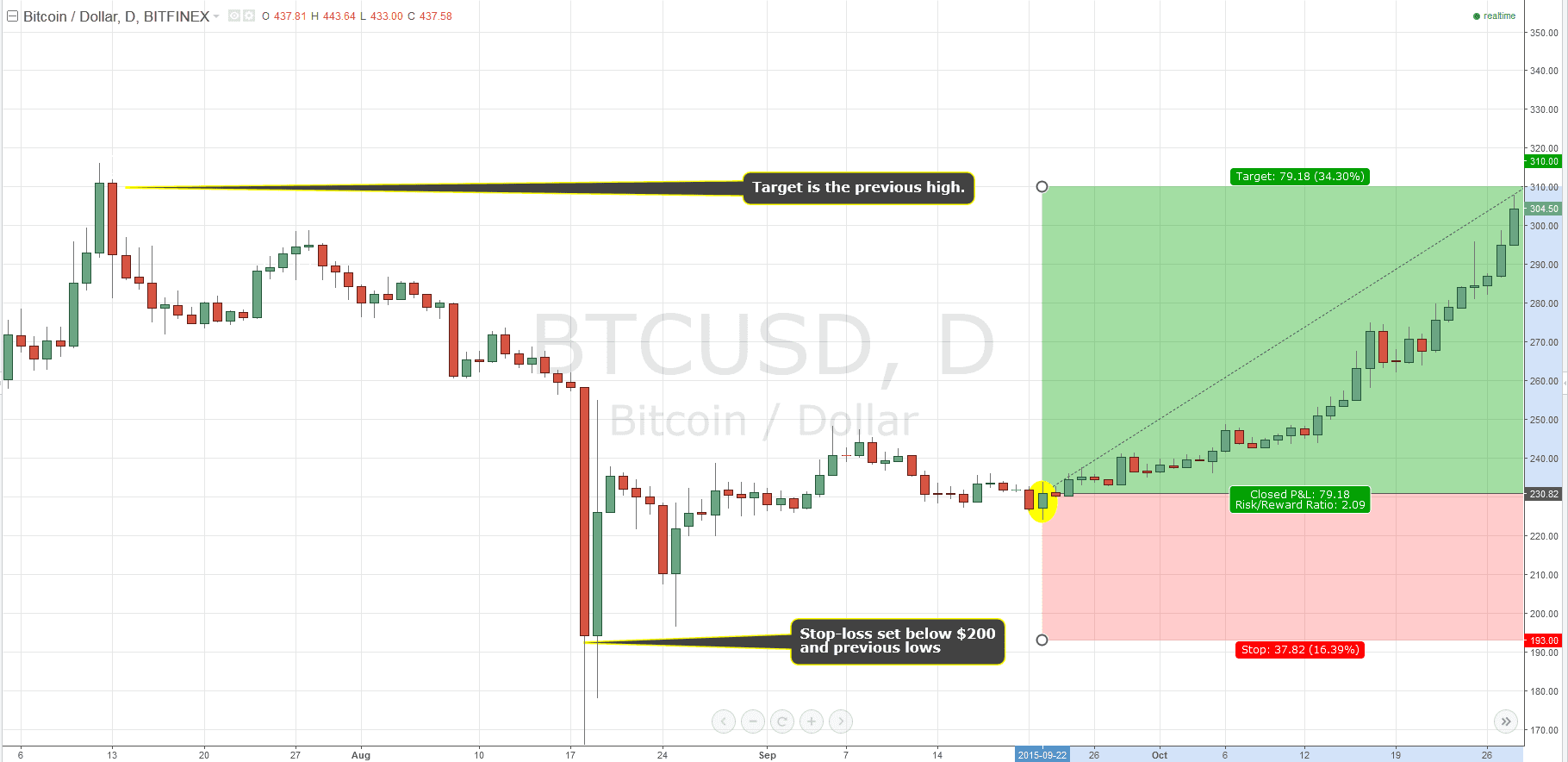

Initiating a trade without a clear exit strategy is a recipe for disaster. Determine beforehand the price at which you’ll cut your losses if the market moves contrary to expectations. This level is known as a stop-loss and it’s critical to market survival. Limit your losses below 25% of your position size. A stop-loss is wisely placed on the other side of a level at which price has reversed previously, the more times the better.

The converse of a stop loss is the profit target; the level(s) at which profit is taken when price behaves as expected. Profit targets are best-placed slightly before previously significant levels. If price exceeds your expectations by penetrating significant previous levels and maintaining a strong trend thereafter, consider substituting your target(s) for a trailing stop; this acts as a ratchet on your profits.

Finally, know your breakeven point; the price at which you can exit a trade without incurring any loss due to trading fees. If you enter a trade only for the market to meander sideways, consider exiting at breakeven rather than wasting time and energy on monitoring a flat market.

Exercising discipline in regards stop-losses and targets is the best way to manage greed and fear. Placing stop loss and profit target orders immediately after entering each trade is a good habit to acquire.

Risk / Reward Ratio

Consider that setting a stop-loss of negative 25% in combination with a profit target of positive 50% affords a risk / reward ratio of 1:2. Adhering to this methodology, one good trade compensates for two bad ones. It’s fair to assume that a trader’s odds of success are roughly even on each trade. Therefore, selecting only trades which will potentially satisfy a 1:2 (or better!) ratio should ensure consistent profitability over time. Of course, markets are seldom predictable. Their randomness means that consecutive losses should be anticipated and guarded against through proper position sizing.

Trading Tips

Hang around traders online or in-person and you’ll soon discover countless, sometimes contradictory, rules of thumb:

Buy low and sell high advocates buying when prices are low and selling when prices are high. Obvious enough, although difficulty arises due to the utter subjectivity of the terms “low” and “high.” Whether the current price represents value can only be assessed within the context of historical levels and expected future performance. This maxim may also be expressed as buy fear, sell greed.

Sell high and buy low , the reverse of the above, is applicable when going short.

For every buyer, there’s a seller expresses the simple truth that there are two sides to every trade. Generally speaking, trades occur because sellers consider the price high and buyers consider it low. Sustained price moves result from either buyers or sellers being more aggressive in crossing the spread. In other words, whichever side is collectively more willing to pay the difference between bid and ask prices in order to initiate a trade, will move price in their desired direction. This can also be expressed as a market being bullish or bearish.

Timeframes Define Bitcoin Traders

The various types of Bitcoin traders are primarily distinguished by the timeframes they employ. Only consider a trader’s market view with reference to their timeframe context:

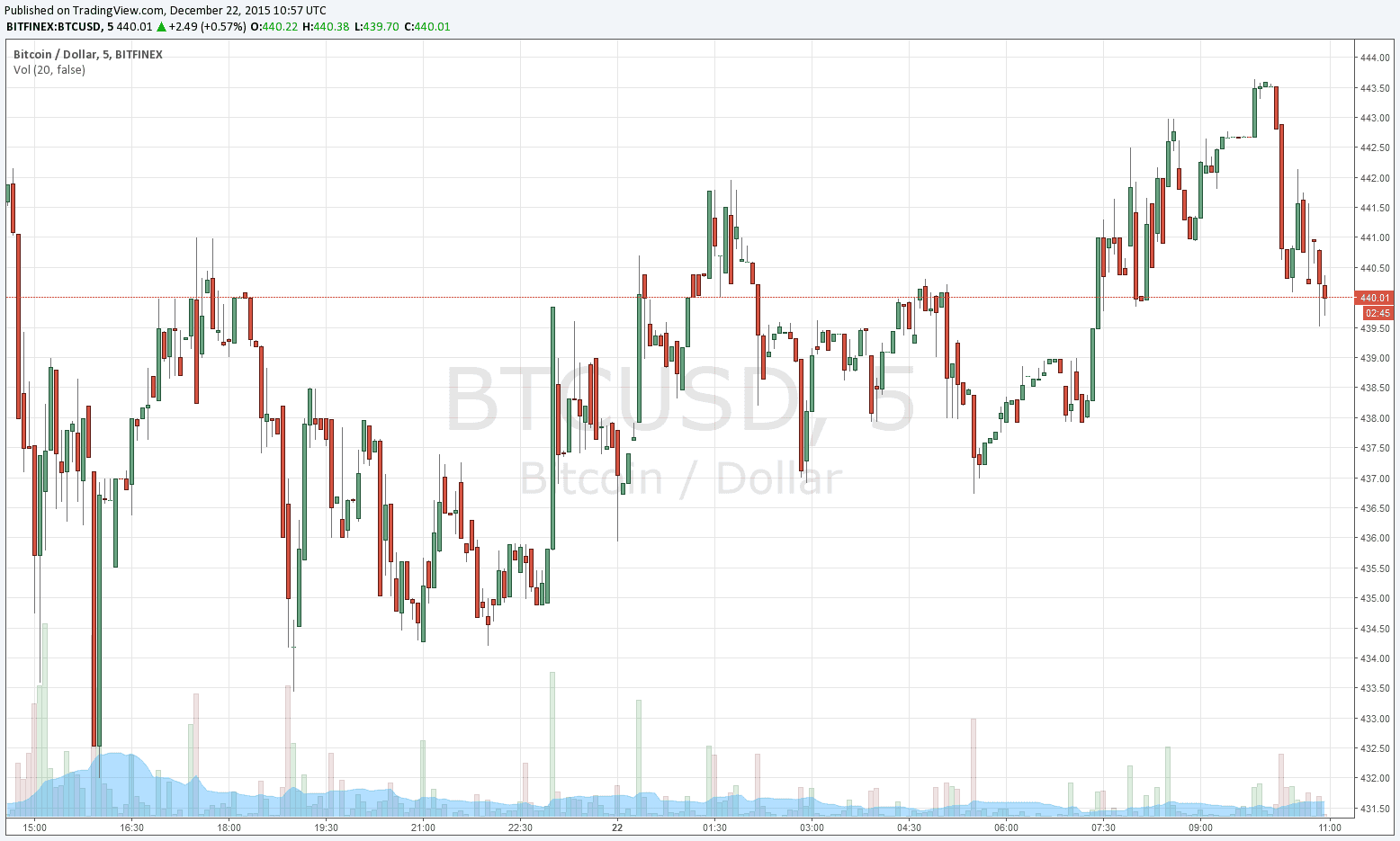

Bitcoin scalpers usually trade on a 5 minute or lower timeframe, sometimes following tick charts which record every single trade without reference to time. Scalpers seek to profit from fleeting imbalances between buyers and sellers. They may make hundreds of trades over the course of a single day. For obvious reasons, such traders are particularly common on Bitcoin exchanges which offer zero or minimal trading fees.

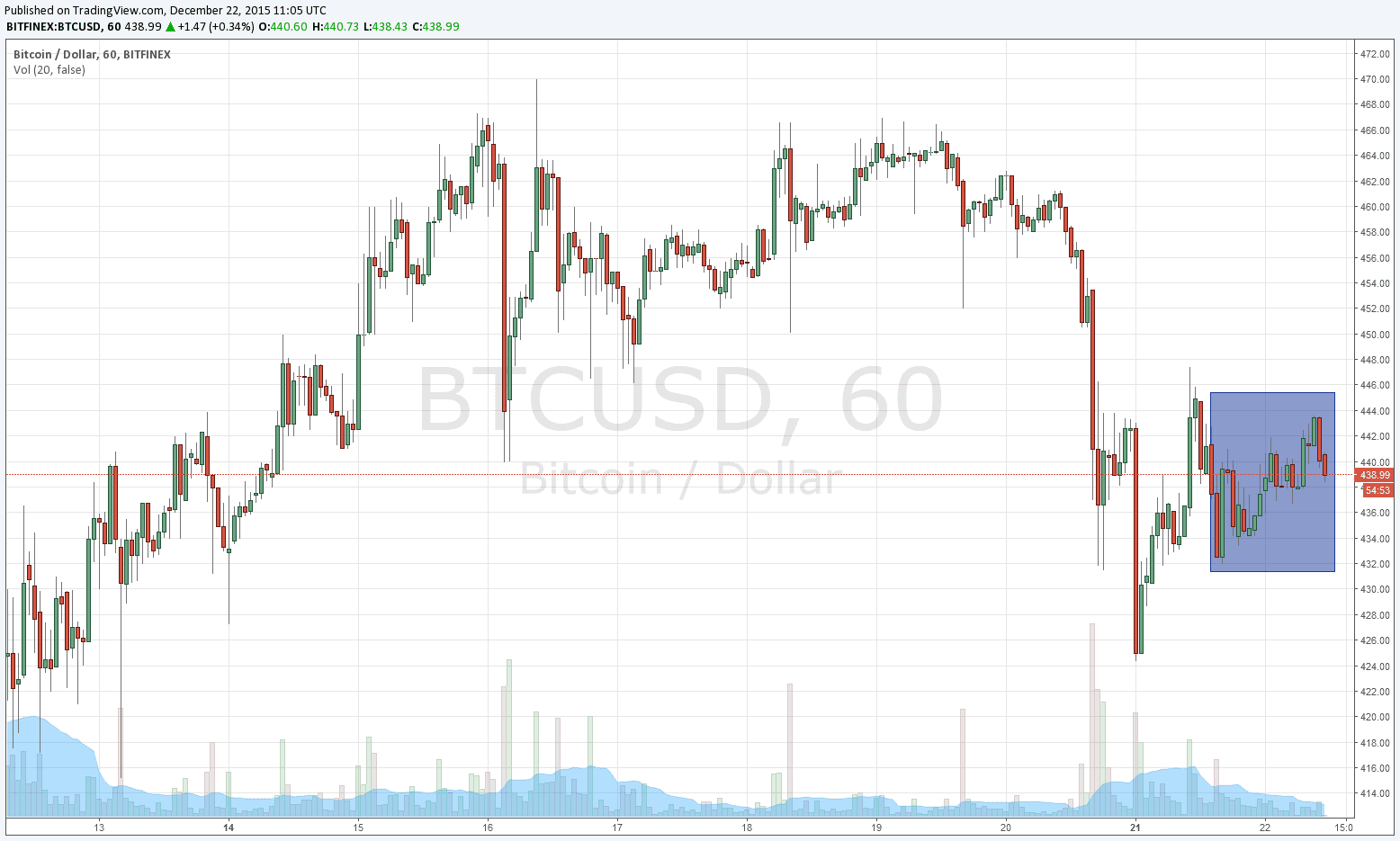

Those who seek to profit from larger Bitcoin price moves during the course of their session are known as day-traders. This term originates from traditional stock market traders who refrain from holding positions overnight. Nevertheless, it fits for Bitcoin traders who usually follow half hour, hourly or 2 hour charts.

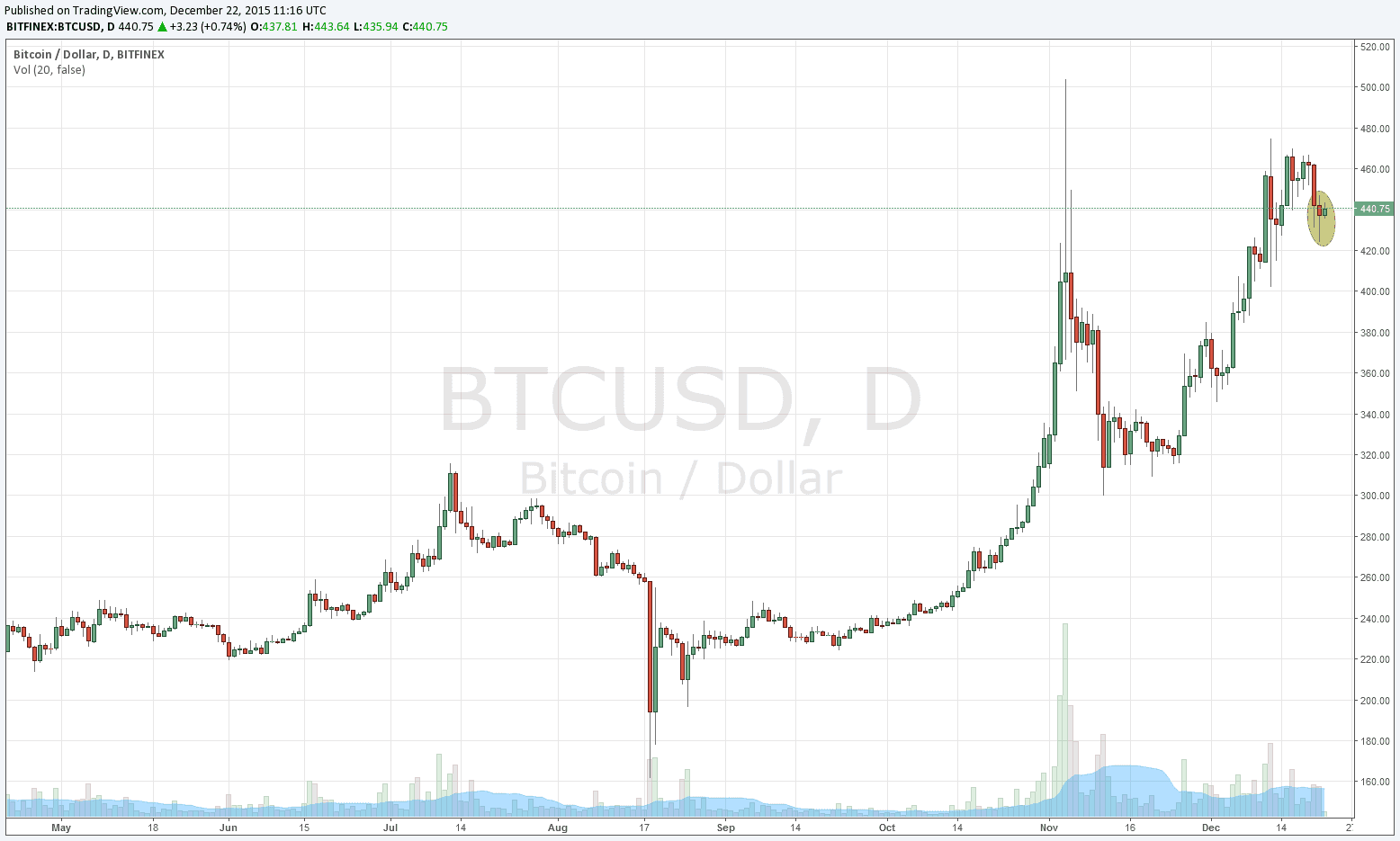

Swing traders or trend traders are those who maintain positions for days, weeks or even months. Such Bitcoin traders attempt to capitalise on large swings within a range-bound market or major trends. They generally follow daily charts, with occasional reference to weekly charts for greater context. They may consult lower timeframes to study price action at important levels or to achieve greater precision on exits and entries.

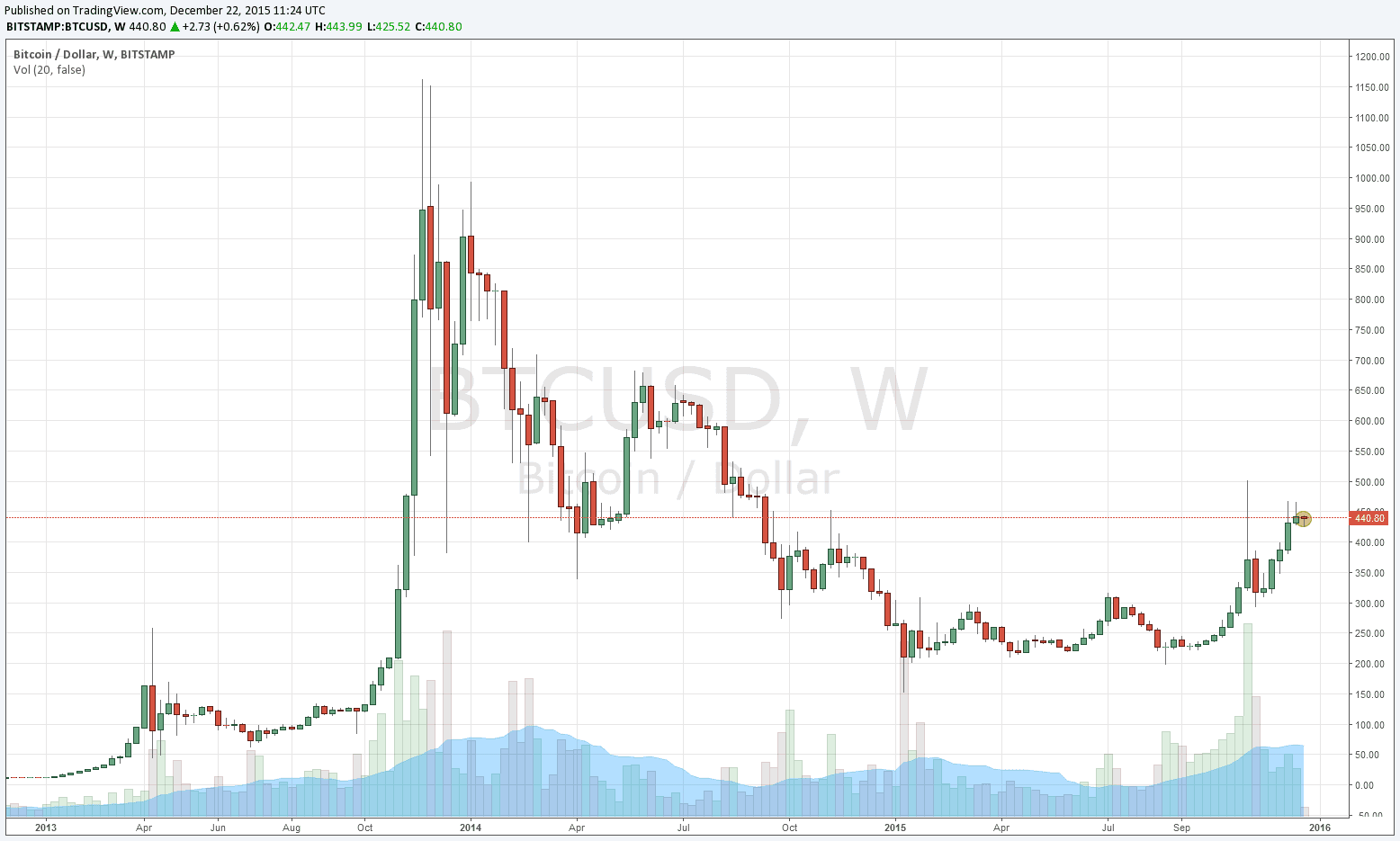

Bitcoin investors are the most likely to time their market actions with reference to weekly or even monthly charts.

Choose your timeframe depending on your desired level of market activity. Scalpers and scalpers follow every trade and commonly conduct multiple trades per day, whereas swing or trend traders check price only occasionally and rarely execute market actions.

A final word of advice regarding timeframes: intelligent traders consider multiple time-frames when planning their trades. When a convincing case for the market’s future direction can be made across all relevant timeframes, it’s time to act!

Trending vs. Rangebound Markets

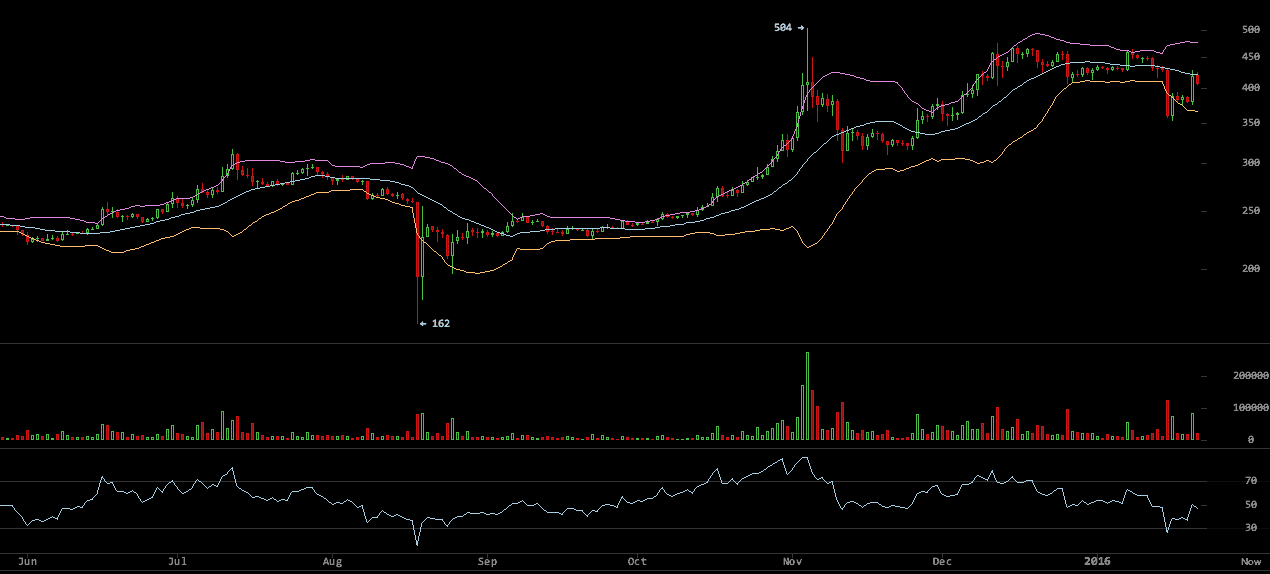

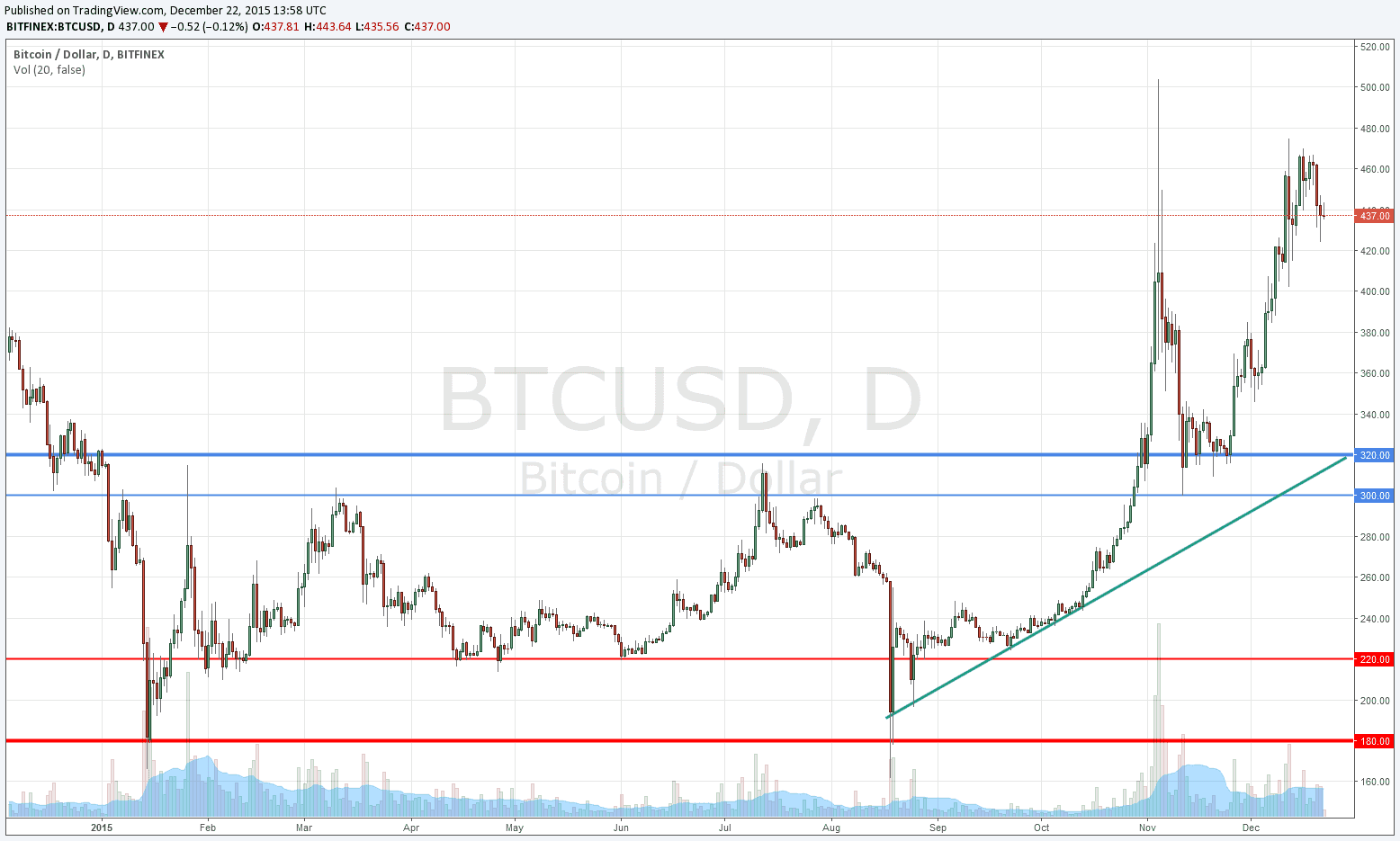

Markets spend the majority of their time rangebound. Price ranges between strong support (the consensus “low” level at which eager buyers absorb all volume offered by sellers) and strong resistance (the converse of support). This rangebound state is best illustrated by the following daily Bitcoin chart from late 2014 to late 2015:

The more frequently price reacts against support or resistance (S/R) levels, the more important such levels become. S/R levels tend to become entrenched at psychologically-significant “big round numbers,” such as $200 and $300 in the above chart.

When S/R lines are slanted, they’re known as trendlines. As alluded to previously, stop-losses are well-placed to the other side of trend or S/R lines - if they’re decisively penetrated on high volume it’s a strong signal that momentum has shifted.

In mid-August, an upwards trend, denoted by the green line, emerged. This bull trend finally propelled Bitcoin’s price through the $300 - $320 resistance level, on high volume (denoted by the feint red and green bars). As often happens, resistance then became support as the initial impulse to $500 faded.

Enough screen-time will give you a feel for when markets are shifting from rangebound mode (when the winning play is to short at resistance and buy at support) to trending mode (when it pays to hold a position as it overcomes S/R and exit at an emotional extreme). In the above chart, the clue was that price action underwent a change in character around mid-October, transitioning from up-and-down chop to a steady upwards slide. This slide presaged the exciting curl-up on rising volume as market momentum gathered for the decisive upwards break.

What will price do next? Welcome to the mystery of the hard right edge, the as-yet blank area of a chart.

Indicators and Patterns

Charting sites or programs and trading interfaces commonly feature indicators - mathematically-derived visualisations of (sometimes) revelatory market aspects. Common useful indicators include moving averages, MACD, Bollinger Bands, RSI, etc. Before experimenting with the vast array of indicators, it’s recommended to master the basics covered above - money management and stop-loss discipline in particular!

Chart patterns and candlesticks are further tools to assist your trading. Certain topping and bottoming patterns are particularly important. Such things are best explained visually, as on Thomas Bulkowski’s excellent Pattern Site.

Trading Plan

Incorporating all the above strategies and tools into a coherent trading plan will take a great deal of time, study, experimentation and discipline. A thorough understanding of the Bitcoin-related subjects covered in our Knowledge Base will also greatly improve your trading, particularly when trading events (such as a block reward halving or development milestone).

Once you’ve proven the viability of a particular plan, consider advancing to the next stage of Bitcoin trading: programming a trading bot which connects to your exchange’s API and faithfully carries out your plan whilst you soak up the rays on a tropical beach… Good luck, you’ll need it!

Categories